Where are the Opportunities?

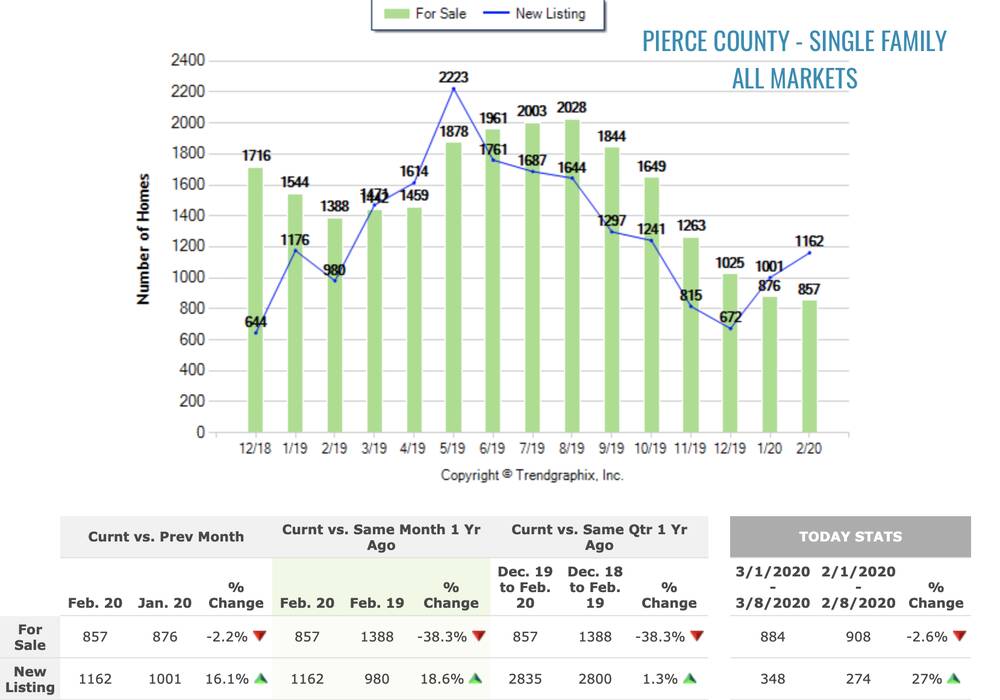

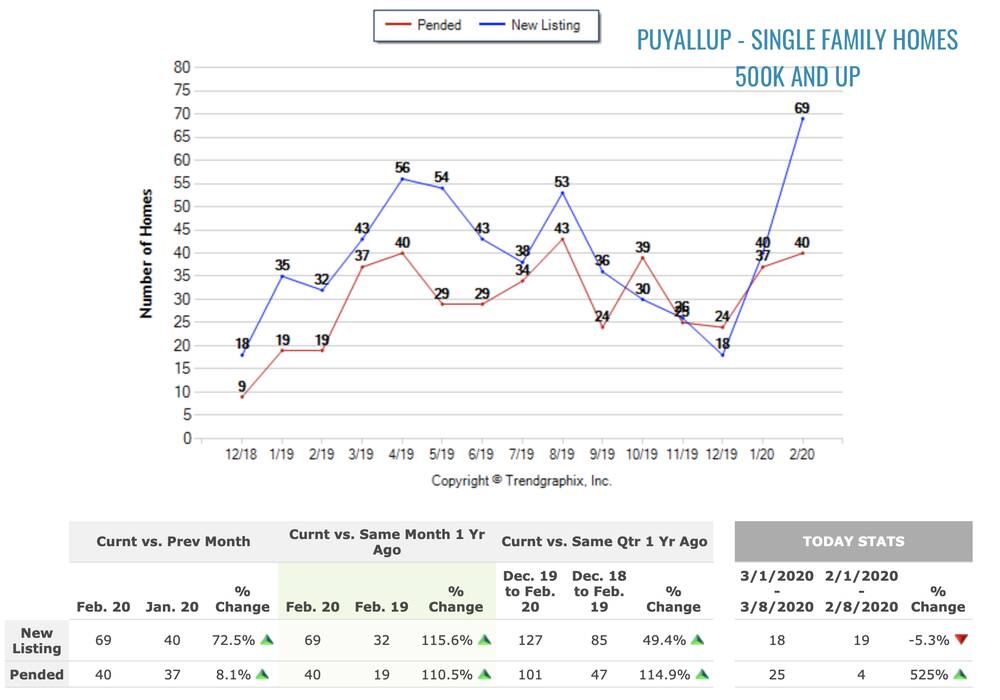

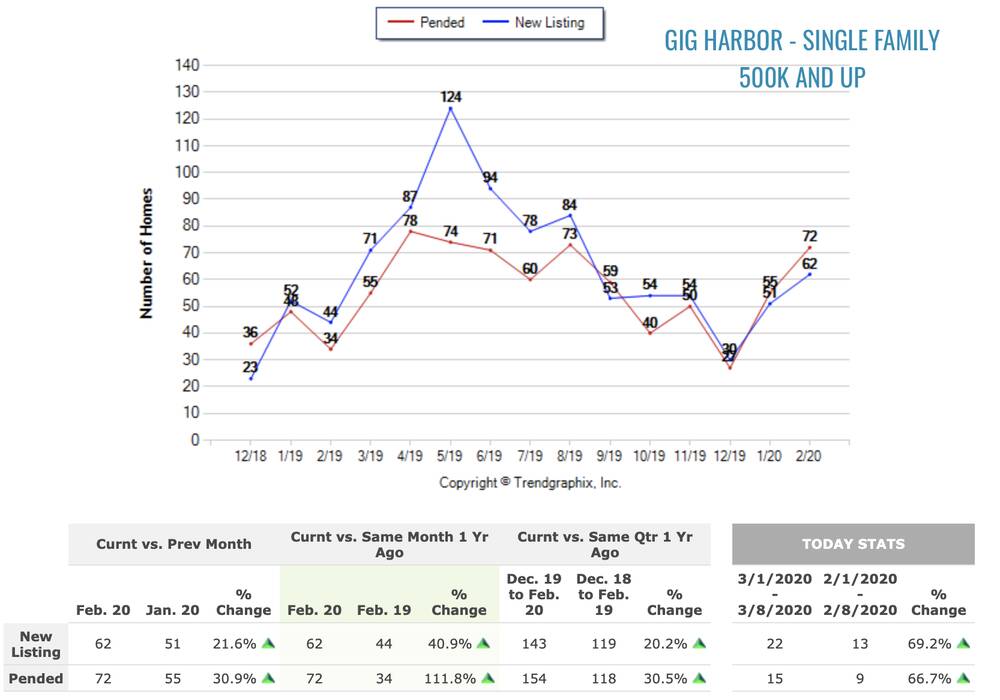

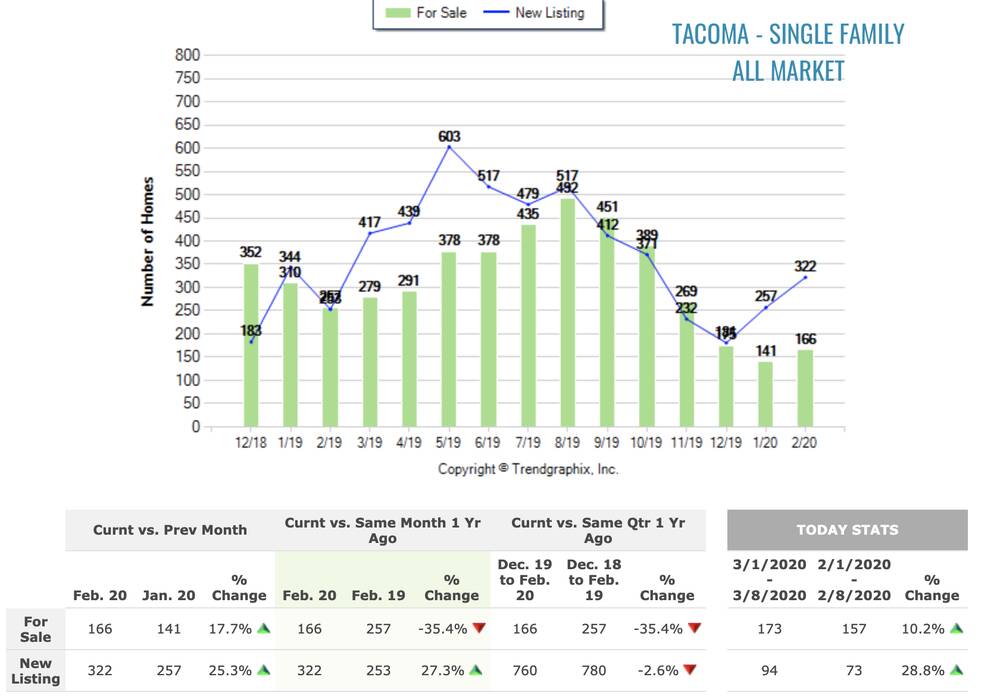

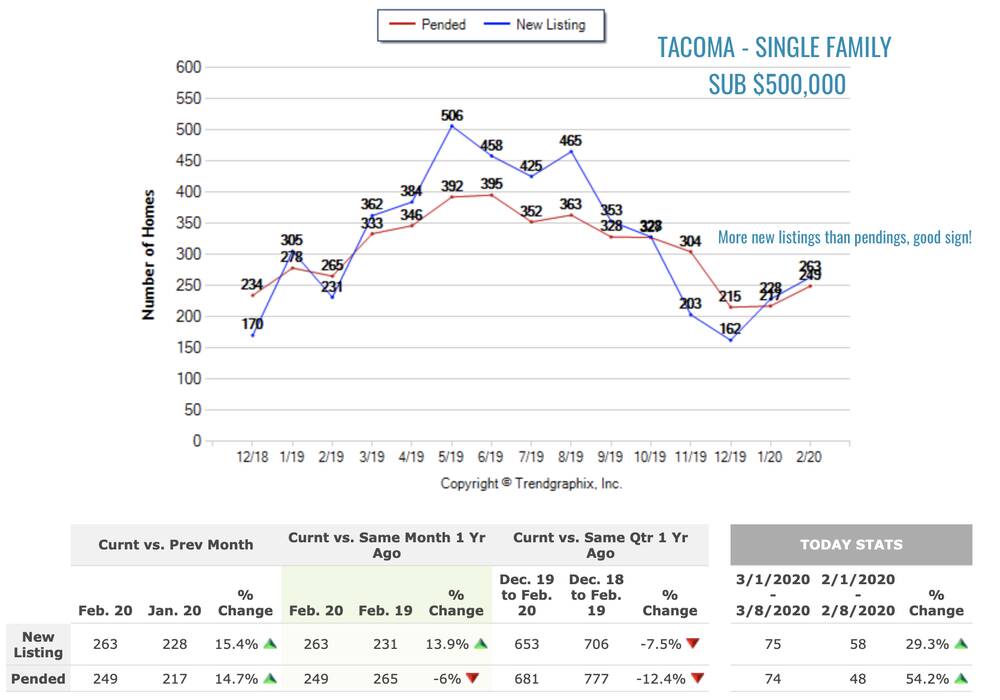

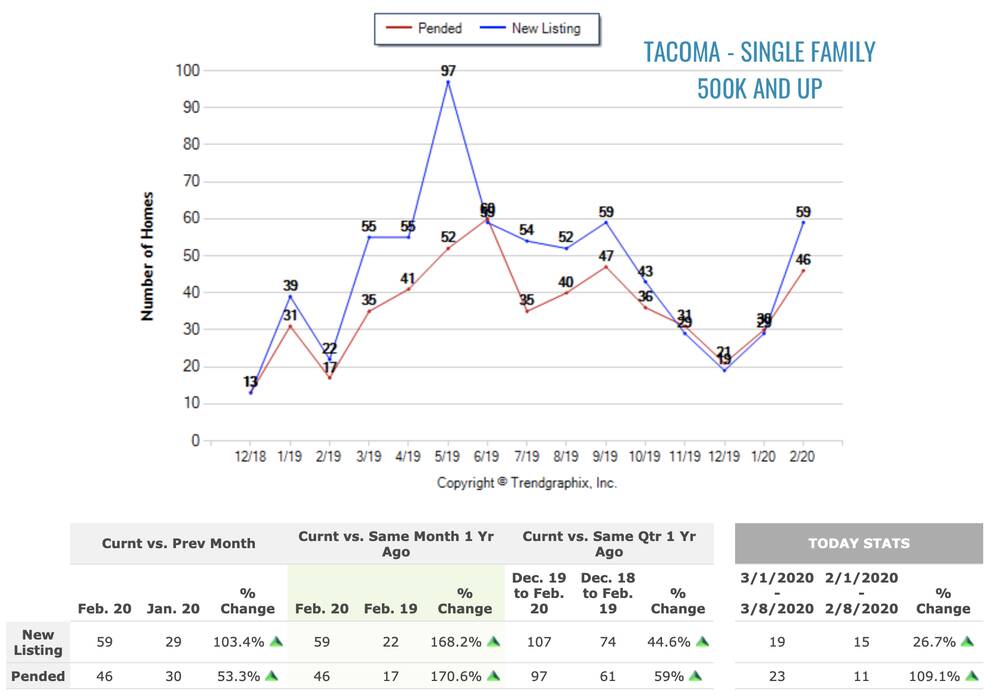

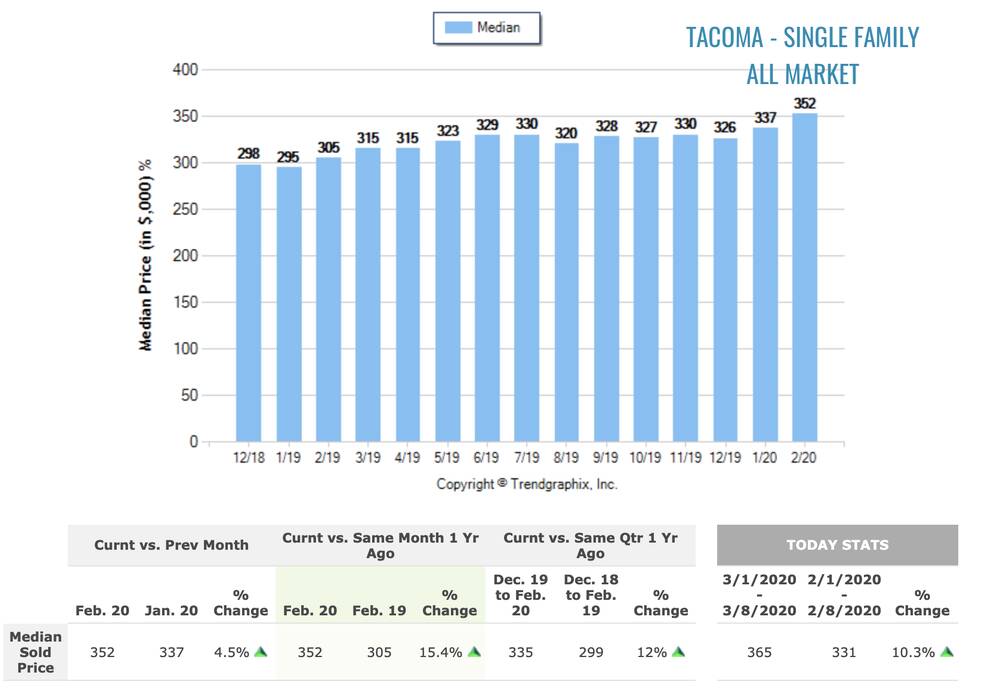

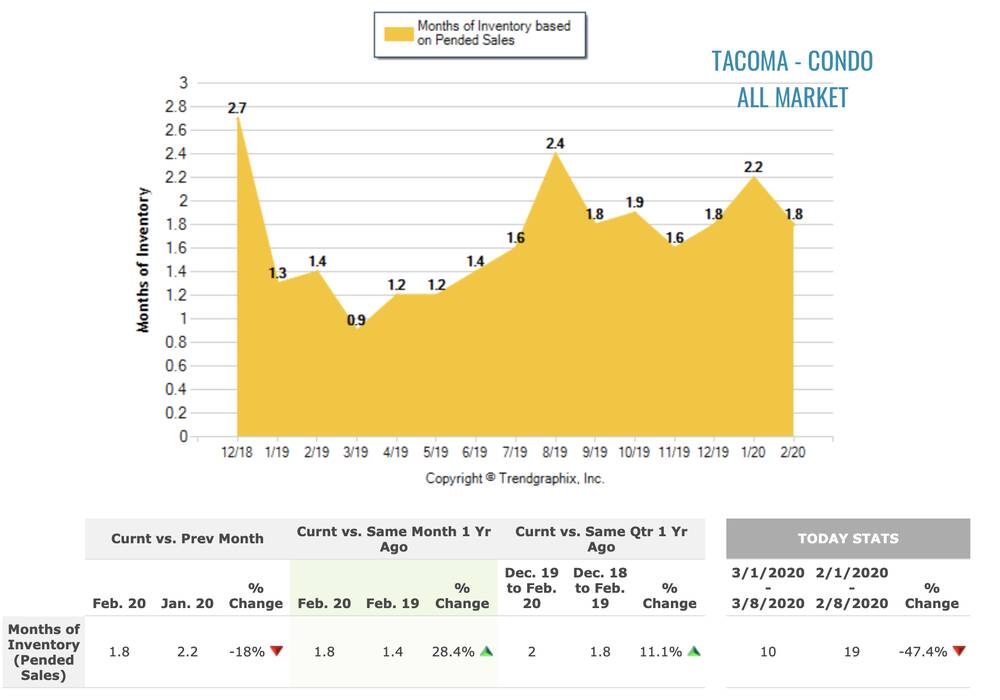

By now, you don’t need me to tell you the Pierce County housing market is on fire… up until this point in the year, we saw the market take off quicker than we have in years past, with inventory shortage being a primary driver. In the month of February, we saw the market adjust slightly, with more listings going on the market. This provided a few more options for buyers who had missed out on properties earlier in the year, and perhaps in 2019.

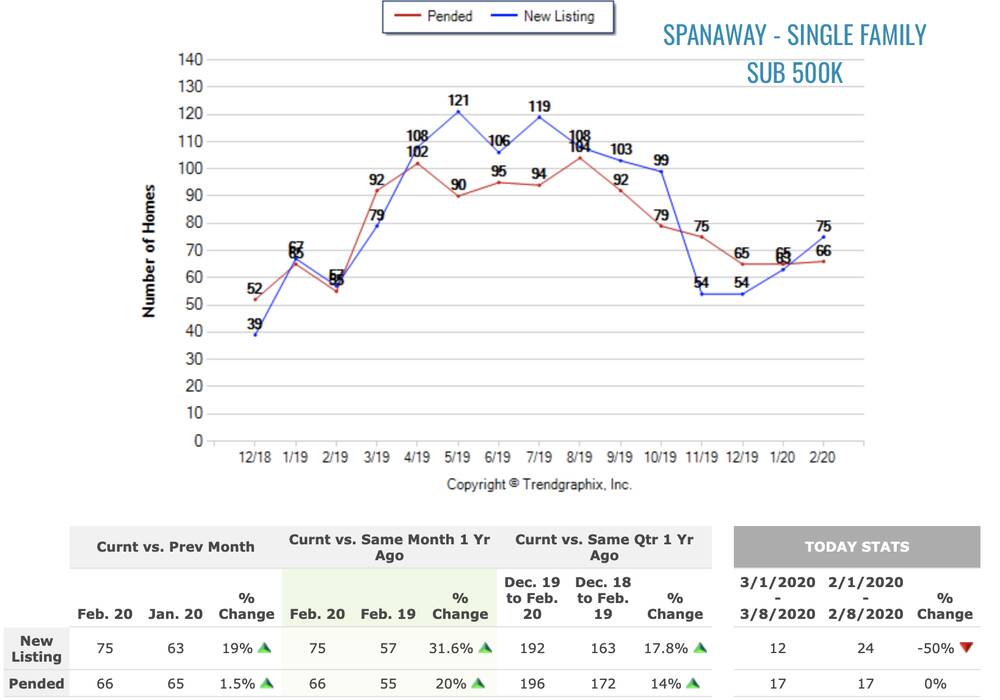

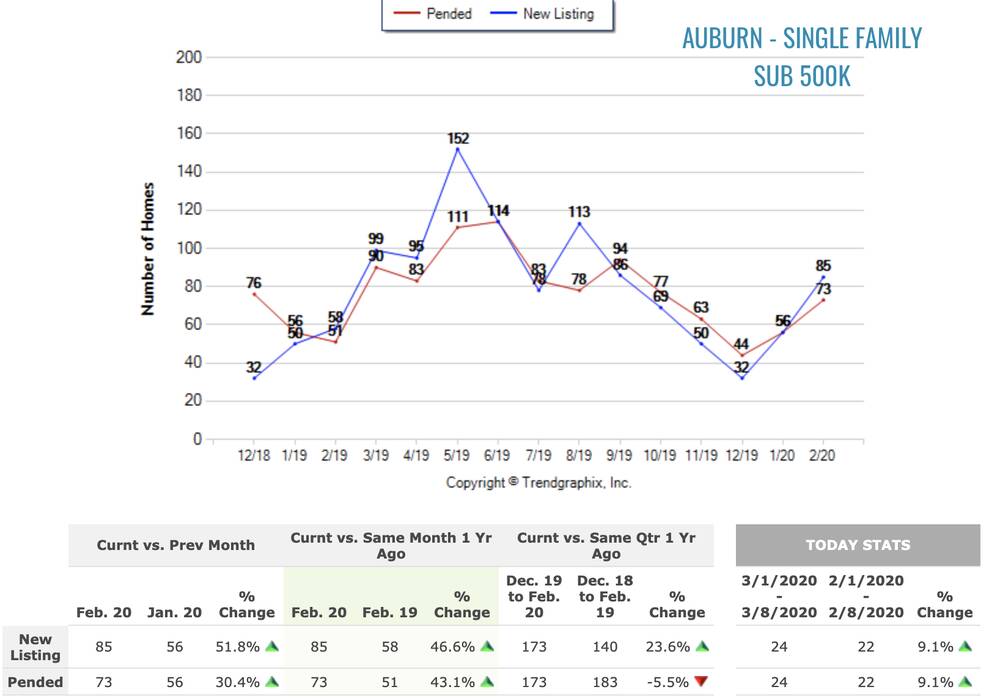

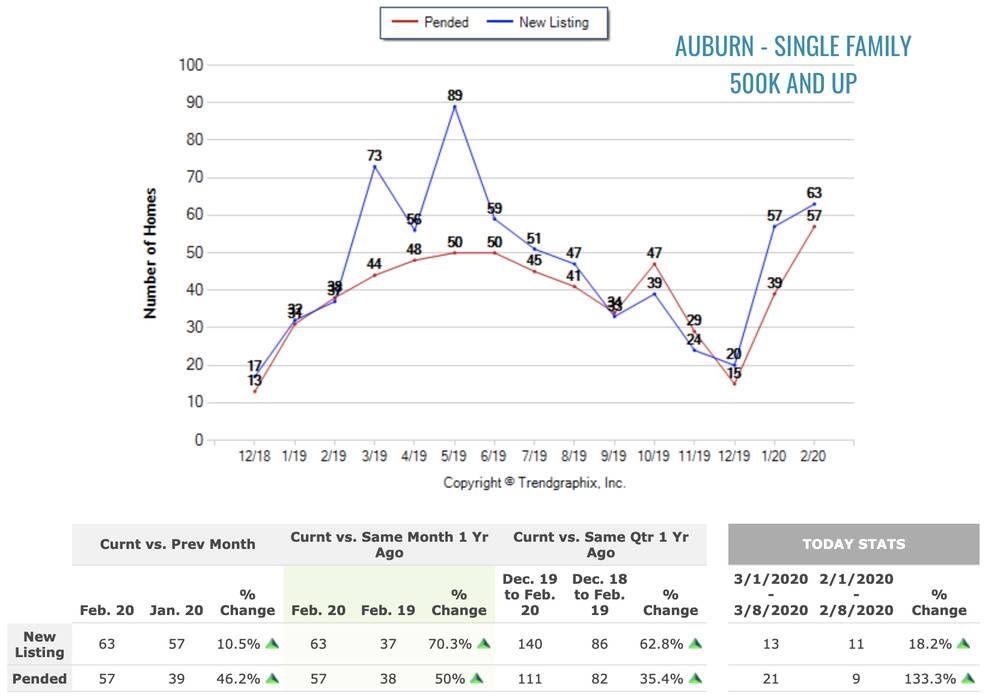

The questions I have thought about over the last month is, where are the opportunities? Let’s dive into the numbers to take at what took place in February of 2020.